property tax assistance program california

The state reimburses a part of the property taxes to eligible individuals. The California State Controllers Office published the current year Property Tax Postponement Application and Instructions on its website.

California S White Homeowners Get Bigger Prop 13 Tax Breaks Calmatters

State Controller Betty T.

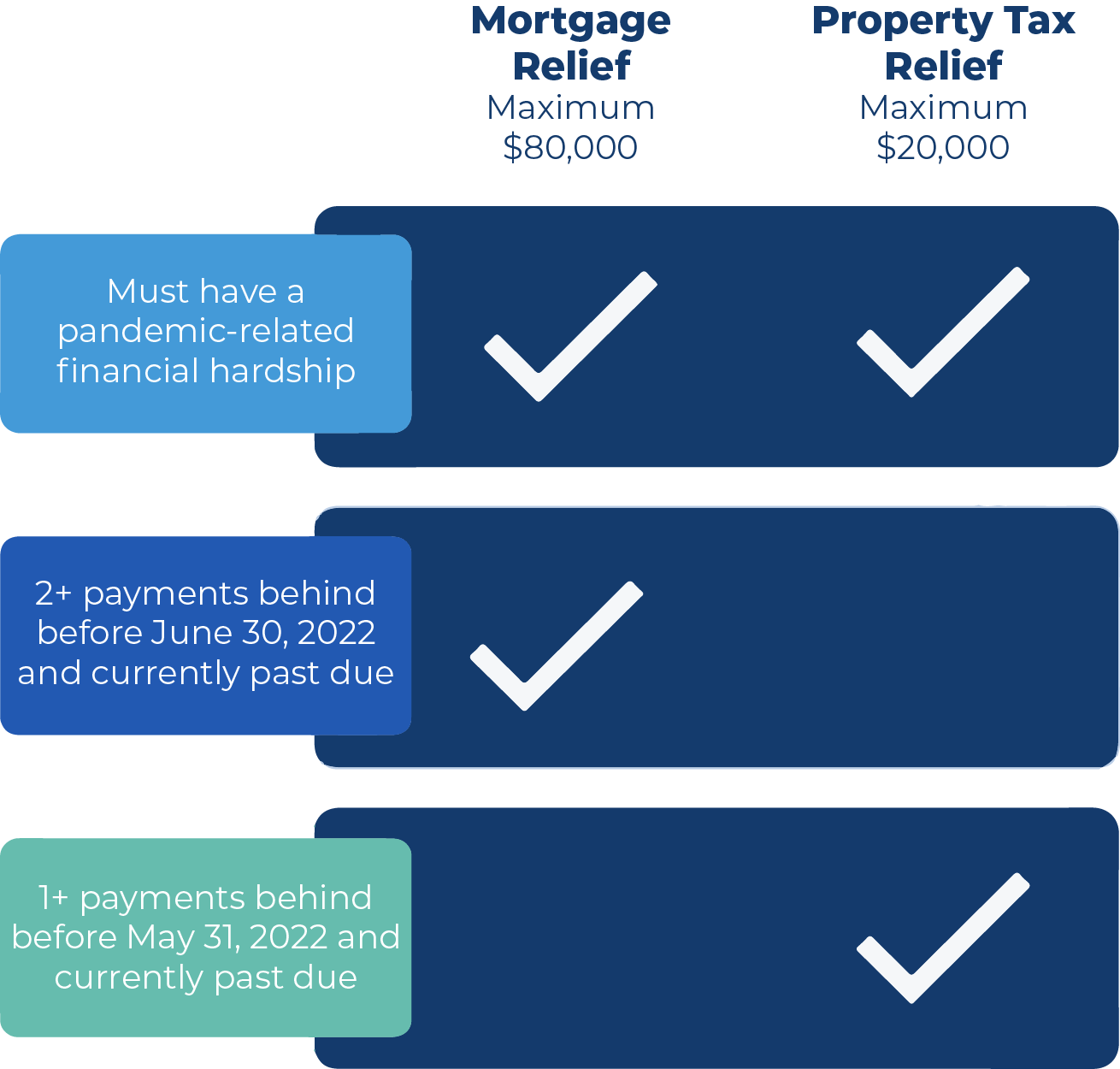

. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. Repayment is secured by a lien against the real property or a security. In July more than 260000 older homeowners renters and people with disabilities started receiving part of a massive 1217 million payout issued through the Property TaxRent.

Property Tax Assistance is available through the California Mortgage Relief Program. Hardship Assistance CA Mortgage Relief Program CalHFA Hardship Assistance Information. A postponement of property taxes is a deferment of current year property taxes that must eventually be repaid.

California Earned Income Tax Credit CalEITC State CalEITC is a refundable tax credit meant to help low- to moderate-income people and families. The exemption applies to a portion of the assessed amount the. CalHFAs Impact On California.

Own a single-family home condominium or permanently affixed manufactured home. Property Tax Assistance Programs California Mortgage Relief Program. If you live in California you can get free tax help from these programs.

September 15 2016. Californias Property Tax Assistance Program aka Gonsalves-Deukmejian-Petris Senior Citizens Property Tax Assistance Law. The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse.

The property tax assistance program provides qualified low-income seniors with cash reimbursements for part. Property Tax Postponment Program. The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are.

Couples who earn between 150000 and 250000 will receive 500 plus 250 for dependents maxing out at 750. Access the application online by visiting the. Update from the State of California Controllers Office On September 28.

The Property Tax Assistance Program. Make 58000 or less generally. Under this program taxes would be paid by the State and the deferred payment would create a lien on the property.

California has three senior citizen property tax relief programs. The maximum credit for an individual with. In December 2021 the State launched the California Mortgage Relief Program to provide assistance to homeowners who fell behind on their housing payments due to financial.

The rebate amounts decline by income until they phase. Candidates should apply for the program every year. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners with a mortgage a reverse mortgage or who are mortgage-free get.

Soldier Sailer Civil Relief Act of 1940. Volunteer Income Tax Assistance VITA if you. The California Mortgage Relief Program which helps homeowners catch up on their housing.

Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax. Homeowners can check their eligibility apply for property tax relief and obtain.

Denver Expands A Property Tax Relief Program To Include Low Income Families Denverite The Denver Site

California Mortgage Relief Program

California Mortgage Relief Program

News Flash County Of Humboldt Civicengage

Property Tax Postponement Program Offered Ceres Courier

Camortgagerelief Twitter Search Twitter

California Mortgage Property Tax Relief Program Placer County Ca

Evaluation Of The Property Tax Postponement Program

Northern California Tax Relief

California Mortgage Relief Program

Deducting Property Taxes H R Block

California Mortgage And Property Tax Relief Eligibility Widens Abc10 Com

Delinquent Property Tax Loan Help In California Home Savers

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

2 Million People Could Get Property Tax Rebate Checks Worth Nearly 1k

California Mortgage Relief Program

Property Assessed Clean Energy Programs Department Of Energy