how long does the irs have to collect back payroll taxes

The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. This law helps us provide generations of.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. A tax assessment determines how much you owe. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

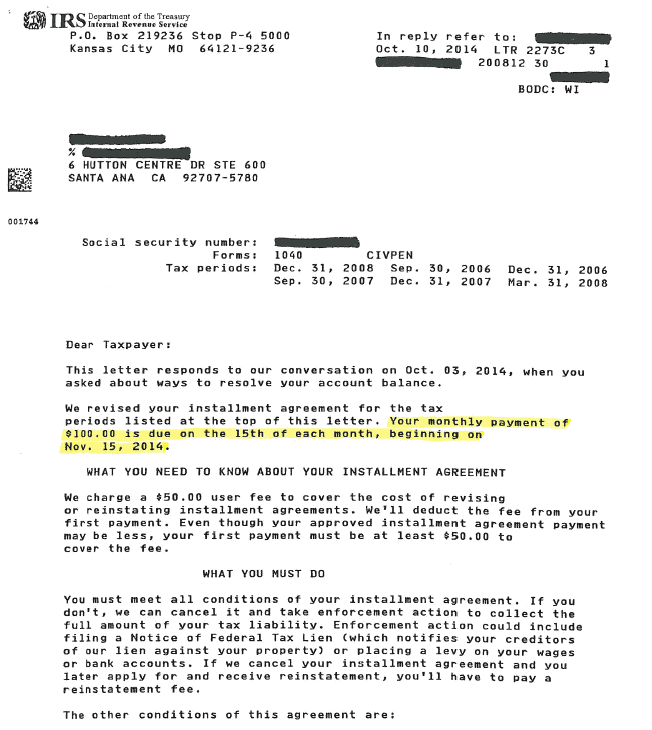

Ad You Dont Have to Face the IRS Alone. If you file early lets say January 31 2020 the IRS has until April 15 2030 to collect. If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4.

If you dont pay on time. With monthly deposits payroll taxes for one month must be provided by the 15th of the following month. The statute of limitations for collections is 10 years.

Understanding collection actions 4 Collection actions. If you file your return 2019 return late say Jan 1 2022 then the IRS has until JAN 1. This means that the IRS can attempt to.

How far back can the IRS collect unpaid taxes. The PACT Act is a new law that expands VA health care and benefits for Veterans exposed to burn pits and other toxic substances. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

See if you Qualify for IRS Fresh Start Request Online. First and foremost the statute is carefully crafted to read. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment.

The IRS generally has 10 years from the date of assessment to collect on a balance due. Get the Help You Need from Top Tax Relief Companies. Semi-weekly deposit schedules require employers to deposit taxes for Wednesday.

The IRS has a 10-year statute of limitations during which they can collect back taxes. Owe IRS 10K-110K Back Taxes Check Eligibility. After a period of 10 years on the statute of limitations the IRS is unable to collect unpaid taxes But there.

IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The IRS has a limited amount of time to collect back taxes.

Generally IRS has up to 10 years to collect a liability from the date of assessment. By law the irs only has ten years to collect the unpaid taxes from the. Lets start with the good news.

When does the IRS statute of limitations period begin. The same rule applies to a right to claim tax. How long does the IRS have to collect past due tax balances.

If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date. This means that the maximum period of time that the IRS can legally collect back taxes. Ad Owe back tax 10K-200K.

How Long Does The IRS Have To Collect Back Taxes. The irs considers unpaid payroll taxes a very serious violation. However lots of things can extend that time including filing for.

There is an IRS statute of limitations on collecting taxes. For a lot of people that statement right there will help them breathe a sigh of relief. This is known as the.

The collection statute expiration ends the. As a general rule there is a ten year statute of limitations on IRS collections.

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

How Far Back Can The Irs Go For Unfiled Taxes

How Far Back Can The Irs Collect Unfiled Taxes

Can The Irs Take Or Hold My Refund Yes H R Block

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Irs Payroll Tax Rjs Law Payroll Tax Attorney San Diego California

Irs Delays Start Of Tax Filing Season To Feb 12

What To Do If You Owe The Irs And Can T Pay

Irs Tax Refunds What Is Irs Treas 310 Marca

Are There Statute Of Limitations For Irs Collections Brotman Law

How To Find Your Irs Tax Refund Status H R Block Newsroom

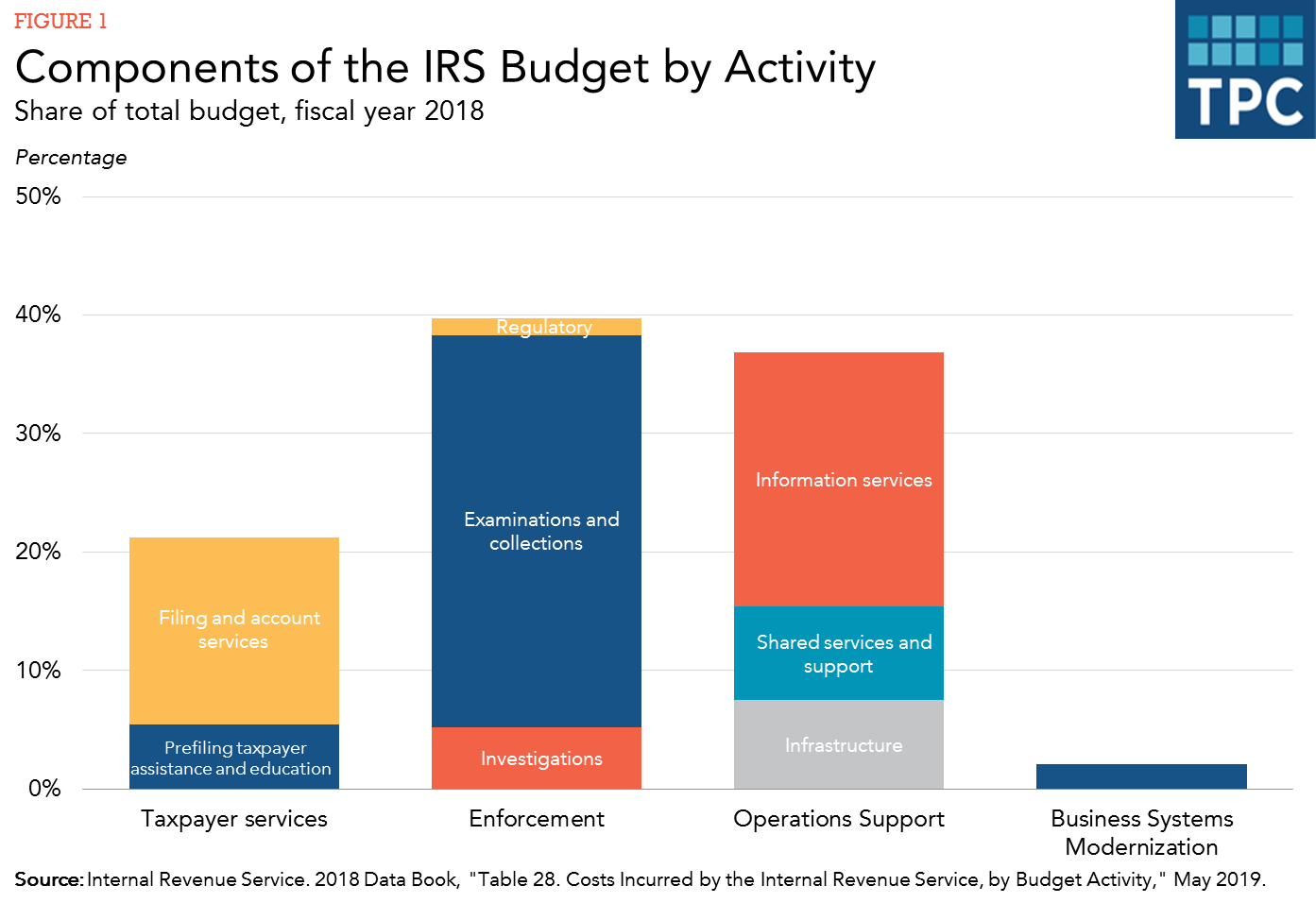

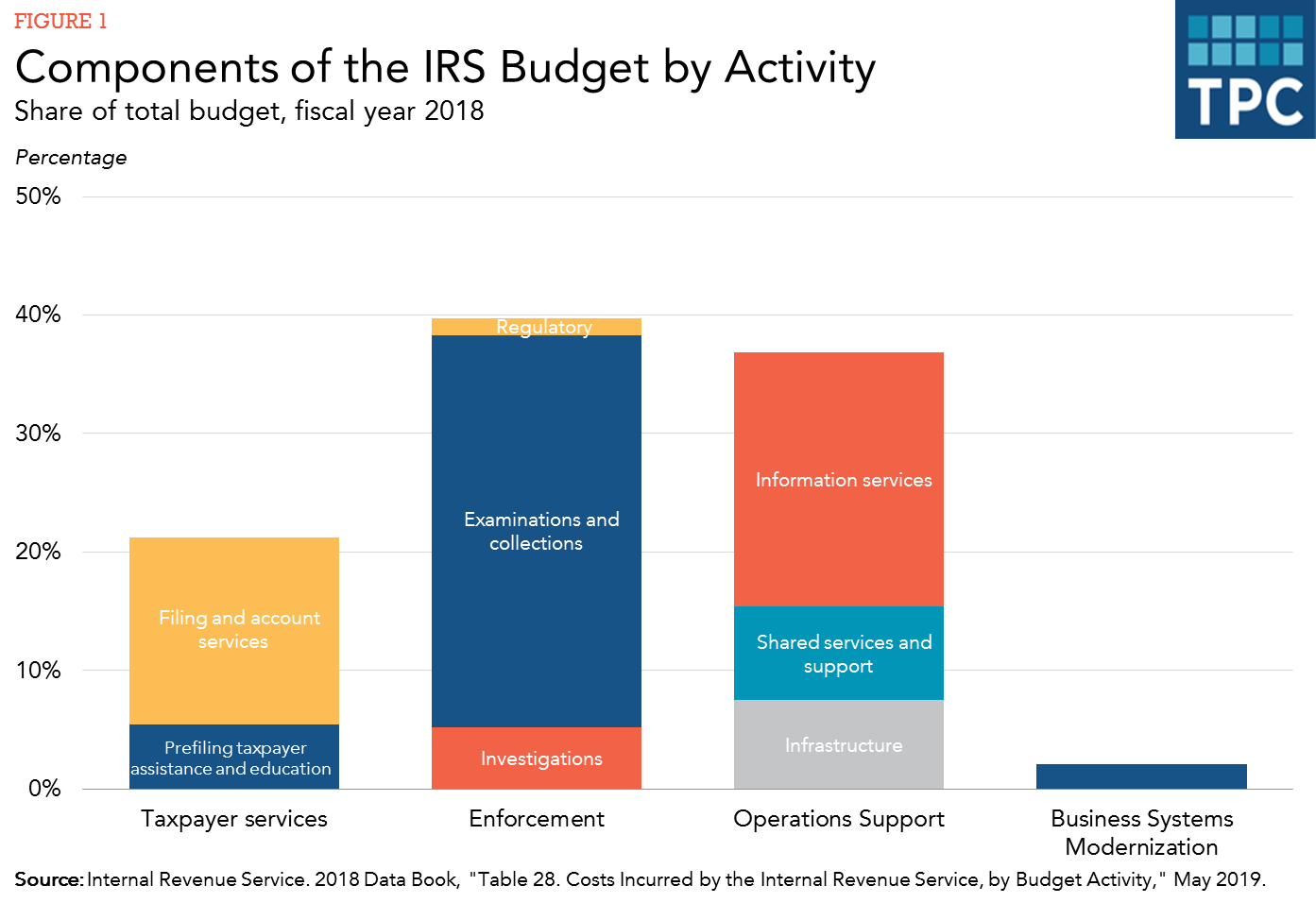

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

4 Steps To Pay Off Your Income Tax Bill Irs Tax Bill Taxact

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

/IRS-4e41b1914e44408786b4537951deabcd.jpg)